December 3, 2024

Financial planning is often considered the most renowned topic in every era. With continuously upgrading digital product engineering solutions, the financial industry is also witnessing a progressive curve.

It not only improves the way financial exchange is done but also improves the profit-earning techniques. How we handle, spend, save, and invest our money is completely transformed by financial technology, or “fintech.”

Fintech applications are growing in strength as smartphones become more integrated into our daily lives, giving us tools to manage our money.

In this article, we’ll look at nine innovative fintech startup ideas or fintech app concepts that have the potential to become successful businesses.

These creative fintech startup ideas tackle typical financial problems and opportunities, improving everyone’s access to effective, frequently cheaper money management.

These fintech business concepts demonstrate how fintech business opportunities can change our interaction with money, from micro-investing to AI-powered financial advising.

Whether you’re an entrepreneur searching for your next big venture or just interested in what the financial industry will look like in the future!

What Are Fintech Apps?

Financial technology applications, or fintech apps, are cutting-edge software products created to transform how we manage our money.

By utilizing technology, these digital tools allow us to access financial services directly through our computers or mobiles.

Fintech applications or finance apps strive to improve the usability, efficiency, and accessibility of financial tasks, ranging from lending and payments to investing and budgeting.

At RichestSoft, we know how financial software development may revolutionize the modern digital economy.

Our team of knowledgeable financial analysts and full stack developers makes endless efforts to offer creative solutions to financial difficulties.

The fintech business plan empowers businesses and their users by giving users control over their financial situation and creating new avenues for development and success.

Latest Technology Trends In The Fintech Industry

The fintech sector is developing quickly due to shifting user expectations and technology breakthroughs.

The way financial services are provided and used is changing due to these advances.

Let’s examine some of the key technological developments that are now changing the fintech industry:

1. Machine Learning And Artificial Intelligence

Fintech is transforming because AI and ML make services more efficient and tailored.

These technologies enable automated fraud detection, AI chatbots to assist with customer support, and predictive analytics for investment choices.

AI algorithms may analyze large volumes of data, which can then be used to automate trading methods, provide more accurate credit risk assessments, and provide customized financial advice.

2. Bitcoin and Blockchain Technology

Fintech involves utilizing blockchain technology for various purposes. Blockchain was first created for cryptocurrencies like Bitcoin.

Due to its decentralized and transparent nature, blockchain is perfect for safe, quick, and inexpensive transactions.

In addition to cryptocurrency, blockchain is utilized for supply chain financing, smart contracts, and digital decentralized identity verification.

Related Topic: How will Blockchain Transform Banking FinTech in the Future?

3. APIs and Open Banking

Fintech startups and traditional banks are increasingly working together because of open banking efforts.

Banks can safely exchange client data with outside suppliers using APIs (Application Programming Interfaces), which facilitates the creation of cutting-edge financial goods and services.

4. Robotic Process Automation (RPA)

RPA is making financial back-office processes more efficient. By automating repetitive processes like data entry, account reconciliation, and compliance reporting, RPA lowers errors, saves money, and frees up human resources for higher-value work.

5. Verification Using Biometrics

In the finance industry, biometric authentication is becoming more and more crucial as cybersecurity worries rise.

More convenient and safe methods of obtaining financial services are provided by technologies such as voice authentication, facial recognition, and fingerprint scanning.

6. Voice-Operated Financial Services

Voice assistants like Apple’s Siri, Google Assistant, and Amazon’s Alexa are beginning to be used in financial services.

Voice commands are now available to check account balances, make payments, and receive financial advice.

This technology is increasing accessibility to financial services, especially for people struggling with traditional interfaces.

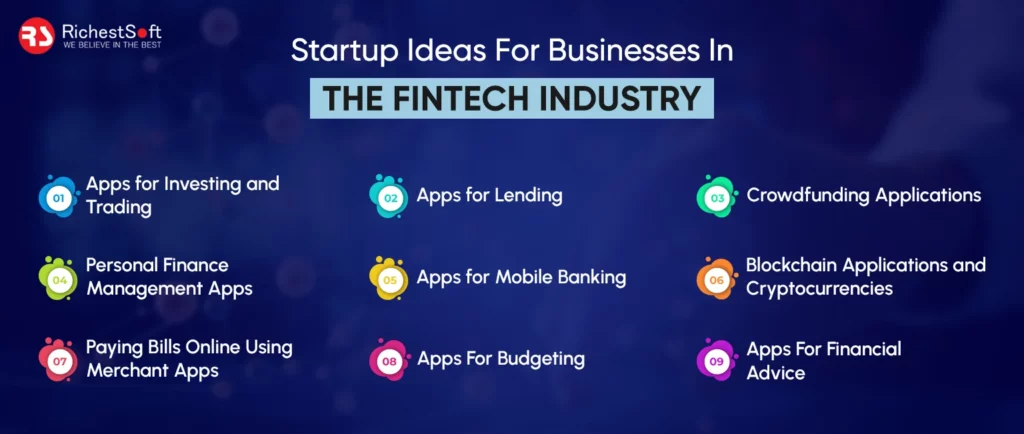

Startup Ideas For Businesses In The Fintech Industry

Fintech applications are leading the change by offering creative fixes that improve the effectiveness, efficiency, and accessibility of financial management.

This section will examine nine innovative fintech business ideas that could grow into profitable businesses.

These fintech startup ideas cover typical financial possibilities and problems, providing fresh methods for lending, investing, budgeting, and other financial tasks.

🗹 Apps for Investing and Trading

These fintech applications provide low-cost, user-friendly platforms that make trading and investment accessible to everybody.

They offer tools for studying stocks, bonds, and other securities, as well as real-time market data and educational materials.

Developing stock trading apps enables users to manage their portfolios effectively and accumulate money by democratizing investment options.

🗹 Apps for Lending

Lending apps eschew traditional financial institutions by bringing borrowers and lenders together directly. They offer peer-to-peer, business, and personal loans.

These fintech applications frequently evaluate creditworthiness using sophisticated algorithms, expanding the pool of potential borrowers and lowering interest rates.

🗹 Crowdfunding Applications

Crowdfunding platforms facilitate raising funds for individuals and enterprises by allowing many people to contribute small amounts.

These fintech apps can help with various tasks, from startup finance to community efforts.

They provide an open and effective means to collect money, monitor development, and communicate with supporters.

🗹 Personal Finance Management Apps

Personal finance management applications help users track their spending, make budgets, and establish financial objectives.

These apps offer a complete picture of one’s financial situation by connecting to credit cards and banks.

Applications that help users make wise financial decisions include bill reminders, savings strategies, and spending classification.

🗹 Apps for Mobile Banking

With the ease of a smartphone, mobile banking apps provide all the services of a traditional bank.

Users can deposit checks, pay bills, transfer money, and check their balances without going to a bank branch.

These fintech apps frequently incorporate increased security features like biometric authentication to protect users’ financial information.

For more information, learn how much it costs to develop a mobile banking app!

🗹 Blockchain Applications and Cryptocurrencies

Crypto applications help users purchase, sell, and store cryptocurrencies like Ethereum and Bitcoin.

The impact of blockchain technology in the banking industry made transactions safe and transparent.

These fintech apps frequently include features such as tools for managing digital assets, educational materials, and real-time market data.

They serve both new and seasoned cryptocurrency aficionados.

🗹 Paying Bills Online Using Merchant Apps

These fintech applications make interacting with retailers and paying bills easier.

In addition to tracking their payment history, users can schedule recurring payments and receive reminders when payments are due.

These programs give retailers tools for tracking sales, creating invoices, and maintaining client connections.

🗹 Apps For Budgeting

Budgeting applications assist users in making and adhering to a budget by tracking revenue and expenses.

They propose places for saving and provide insights into spending patterns.

With the goal-setting tools in many budgeting apps, users may set aside money for big purchases, trips, or emergency savings.

🗹 Apps For Financial Advice

Financial advisory applications use machine learning and artificial intelligence to offer individualized financial guidance.

They analyze users’ financial circumstances and make personalized savings, investing, and retirement planning recommendations.

How to Make These Fintech Startup Concepts Into Profitable Companies?

Innovative fintech app concepts need careful planning and a strategic approach to become profitable.

Due to the intense regulation and competition in the industry, it is critical to address important issues such as user experience, business model creation, and market validation.

Here, we’ll discuss methods and approaches to assist you in overcoming these obstacles and turning your fintech startup into a successful business:

🡆 Validation and Market Research

Conduct in-depth market research to comprehend your target customer’s requirements and pain points.

Get input on your fintech startup idea via focus groups, questionnaires, and beta testing. Ensure there is a market for your product and that it solves a legitimate issue.

🡆 Reliable Business Model

Create a viable business plan that details the revenue streams for your fintech application. Subscription fees, transaction fees, partnerships, and premium features are common revenue streams.

Give a clear explanation of your value proposition and how it sets you apart from the competition.

🡆 Adherence to Regulations

The financial industry values navigating the regulatory environment. Ensure that your app conforms to all applicable laws and rules, including financial compliance and data protection.

Speak with legal professionals to understand the requirements and obtain necessary licenses.

🡆 Design with the User in Mind

Make sure your UI is simple to use and intuitive. A fintech app’s user experience and usability are key to its success.

Test the usability of the design to find and fix any errors. Make sure the software works flawlessly on all kinds of devices.

🡆 Safety and Credibility

Security must be prioritized to safeguard users’ private financial information. Implement multi-factor authentication, strong encryption, and frequent security audits.

Gaining your users’ trust is crucial, and you can increase your credibility by being open and honest about how their data is protected.

🡆 Strategic Partnerships

Establish collaborations with technology companies, reputable financial institutions, and other pertinent parties.

These alliances can assist you in expanding your clientele, building credibility, and providing more complete services.

Encouraging cooperation between banks and payment processors helps expedite legal compliance.

🡆 Scalability

When designing your app, ensure it is scalable. Your infrastructure should be scalable enough to support growing user numbers without sacrificing efficiency.

Use cloud-based solutions to ensure your app can grow economically and efficiently.

🡆 Marketing and Customer Acquisition

Create a thorough marketing plan to attract and retain users. Use digital marketing platforms like social media, content marketing, and search engine optimization (SEO) to reach your target audience.

Offering free trials, referral schemes, and promotions can increase user acquisition.

Why RichestSoft Is Your Perfect Partner In Fintech App Development?

Selecting the right partner is essential for your financial app development project to be successful and long-lasting.

Because of its vast experience, knowledge, and dedication to providing cutting-edge and dependable solutions, RichestSoft stands out as the best option.

For the development of finance apps, RichestSoft ought to be your prime choice:

- Knowledge: Demonstrated experience creating innovative fintech solutions.

- Innovation: Makes use of cutting-edge technologies to develop creative financial applications.

- Customization: Fits solutions to particular corporate objectives and requirements.

- Security: Uses strong security protocols to safeguard private financial information.

- Compliance: Assures that all pertinent financial norms and regulations are followed.

- Assistance: Offers thorough post-launch assistance and upkeep.

Conclusion

It takes meticulous preparation and astute execution to turn finance startup ideas into successful businesses.

A solid basis for success in the fintech sector may be established by addressing crucial elements.

Using its vast experience, cutting-edge technologies, and dedication to providing safe and customized fintech solutions, RichestSoft is prepared to be your perfect partner on this path.

With RichestSoft, you can rely on it for reliable fintech app development, whether you’re releasing a new app or improving an existing one.

Contact us now to learn how RichestSoft can help your business succeed in the digital market and realize your financial or fintech app idea.

+1 315 210 4488

+1 315 210 4488 +91 99888 06489

+91 99888 06489