June 10, 2025

In today’s fast-paced world, digital technology and data analytics are reshaping almost every industry, and insurance is no exception. For business owners, understanding how digital and analytics are changing the insurance industry is crucial.

This blog explores how digital tools and data analytics are changing the insurance industry, streamlining processes, enhancing customer experiences, and creating new growth opportunities.

What is the Digital Shift in Insurance

The insurance industry has traditionally been characterized by its reliance on paper-based processes and manual labor. However, with the rise of digital technology, this is rapidly changing.

Business owners must recognize that adopting digital tools and analytics is no longer optional—it’s essential for staying competitive.

The shift towards digital transformation involves not just the use of new technologies but also a complete rethinking of how insurance businesses operate and interact with their customers.

The Role of Digital and Analytics in Insurance

The role of digital and analytics in the insurance industry is multifaceted, driving significant changes across the sector.

From artificial intelligence (AI) and machine learning (ML) to blockchain and the Internet of Things (IoT), these technologies are helping insurance companies offer better services and operate more efficiently.

🡆 Artificial Intelligence and Machine Learning

AI and ML are automating tasks like claims processing, underwriting, and customer service. These technologies analyze large amounts of data to identify patterns and predict outcomes.

For example, AI-powered chatbots can handle customer inquiries around the clock, providing instant answers and freeing up staff to focus on more complex tasks.

🡆 Blockchain Technology

Blockchain is a secure and transparent way of recording transactions. In insurance, it helps streamline processes such as claims management, reducing the likelihood of fraud, and fostering trust between parties.

Smart contracts, enabled by blockchain, automatically execute contract terms, speeding up claims processing.

🡆 Internet of Things (IoT)

IoT devices, such as connected cars and smart homes, provide real-time data that insurers can use to assess risk more accurately.

For example, telematics devices in vehicles monitor driving behavior, allowing insurers to offer personalized insurance rates based on individual driving habits.

The Impact of Analytics on Insurance

Data is becoming increasingly valuable in the insurance industry, and analytics is the key to unlocking its potential.

The role of digital and analytics in insurance is pivotal in driving insights that lead to better business decisions.

🗹 Customer Insights & Personalization

Analytics enable insurers to categorize their customers into distinct groups based on factors such as age, behavior, and preferences. This segmentation helps them create products and services tailored to the specific needs of each group.

For example, predictive analytics can identify customers who are likely to switch to another provider, allowing insurers to take steps to keep them.

🗹 Risk Assessment and Underwriting

Traditional methods of assessing risk often rely on broad categories and historical data.

However, analytics enables a more detailed approach by analyzing data from various sources, such as social media, IoT devices, and financial records. This allows insurers to develop more precise risk profiles for each customer.

🗹 Fraud Detection and Prevention

Fraud is a significant issue in the insurance industry, resulting in billions of dollars in annual losses. Analytics can help detect fraudulent activities by identifying unusual patterns in data.

For example, machine learning algorithms can analyze claims data to spot suspicious behavior that might indicate fraud.

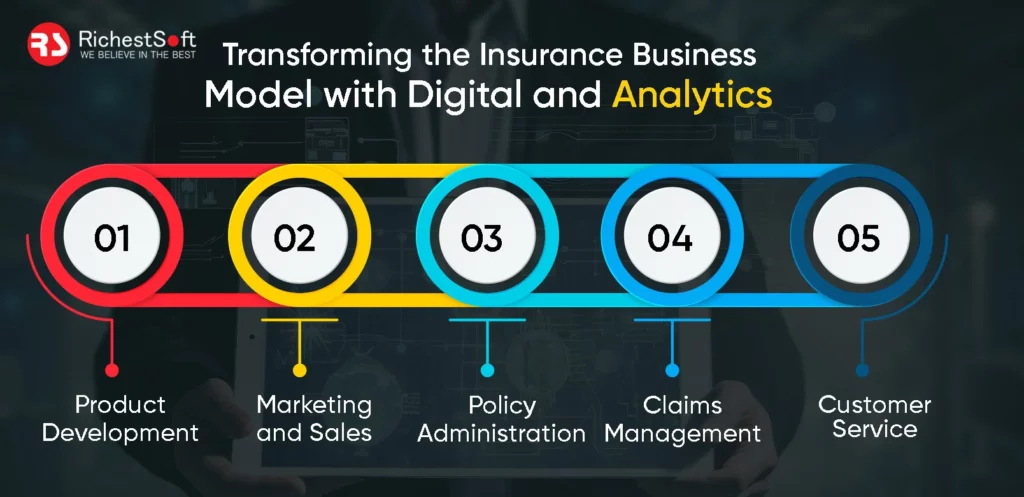

Transforming the Insurance Business Model with Digital and Analytics

How digital and analytics are transforming insurance goes beyond improving existing processes; they are reshaping the entire business model.

This transformation affects every part of the insurance value chain, from product development to customer service.

1. Product Development

Insurers are utilizing data analytics to pinpoint market gaps and develop innovative products that cater to evolving customer needs.

For instance, usage-based insurance (UBI), which charges premiums based on how much a customer uses a service (like miles driven in a car), is a product made possible by telematics data.

2. Marketing and Sales

Digital marketing tools and analytics allow insurers to target their marketing efforts more effectively. By analyzing customer data, insurers can pinpoint the most effective channels and messages to reach their target audience.

Additionally, digital platforms like mobile apps and websites provide customers with a seamless buying experience, from obtaining a quote to purchasing a policy.

3. Policy Administration

Digital transformation has streamlined policy administration processes, including issuing new policies, renewing existing ones, and making changes.

Cloud-based systems enable insurers to manage policies in real-time, providing customers with instant updates and reducing the need for manual work.

4. Claims Management

Managing claims is a critical function in the insurance business. Digital tools and analytics are helping insurers automate and simplify this process, reducing the time it takes to settle claims and improving customer satisfaction.

For instance, AI-powered tools can assess damage from photos submitted by customers, speeding up the claims process.

5. Customer Service

Digital channels, such as mobile apps, chatbots, and social media platforms, offer customers multiple ways to interact with their insurers. Analytics helps insurers understand customer preferences and behavior, enabling them to provide personalized and timely support.

For example, a chatbot can handle routine inquiries, while more complex issues can be escalated to a human agent.

Challenges in Implementing Digital and Analytics in Insurance

Implementing digital and analytics in insurance comes with its own set of challenges, but the rewards make it a worthwhile endeavor for business owners.

Insurers must address issues such as outdated systems, data privacy concerns, and the need for new skills.

🡆 Outdated Systems

Many insurers still use outdated systems that are incompatible with modern digital technologies. Upgrading to new systems can be expensive and time-consuming, but it’s necessary to stay competitive.

Business owners must carefully plan their digital transformation, ensuring they have the necessary infrastructure in place.

🡆 Data Privacy and Security

With the increasing use of digital tools and analytics comes a growing concern about data privacy and security. Insurers must comply with regulations, such as the General Data Protection Regulation (GDPR), to protect customer data.

Implementing robust cybersecurity measures and being transparent about data usage are crucial for establishing trust with customers.

🡆 Talent and Skills

Adopting digital tools and analytics requires a workforce with the right skills. Insurers must invest in training and development to ensure their employees are equipped to handle new technologies.

They may also need to partner with technology providers or consultants to bridge the skills gap.

🡆 Change Management

Digital transformation requires a cultural shift within the organization. Business owners must cultivate a culture of innovation, encouraging employees to adopt new technologies and approaches to work.

Effective change management strategies, including clear communication and employee engagement, are essential for a smooth transition.

Best Practices for Implementing Digital and Analytics in Insurance

For business owners looking to implement digital and analytics in insurance, following best practices is key to success.

- Develop a Clear Strategy: Begin with a well-defined digital and analytics strategy that outlines your objectives and the specific areas you aim to target. This strategy should align with your overall business objectives and involve input from key stakeholders.

- Invest in the Right Technologies: Carefully evaluate the technologies you plan to adopt, ensuring they are scalable, secure, and compatible with your existing systems. Partnering with reputable technology providers can help you access the latest innovations and ensure the successful implementation of these solutions.

- Prioritize Customer Experience: The main goal of digital transformation should be to enhance the customer experience. Focus on initiatives that provide real benefits to customers, such as faster claims processing, personalized products, and seamless interactions across digital channels.

- Use Data to Drive Decisions: Data is a valuable asset, and it should be leveraged to inform decision-making throughout your organization. Advanced analytics can provide useful insights into customer behavior, market trends, and risk factors, enabling you to make informed decisions that enhance your bottom line.

- Create a Collaborative Environment: Successful digital transformation requires collaboration across different parts of your business and with external partners. Foster a collaborative environment where employees, technology providers, and other stakeholders can work together to achieve common goals.

- Monitor and Improve Continuously: Digital transformation is not a one-time project but an ongoing process. Regularly monitor the performance of your digital and analytics initiatives and make adjustments as needed. This continuous improvement will help you stay competitive in a rapidly changing market.

Conclusion

The integration of digital and analytics in insurance offers significant advantages, including improved efficiency, enhanced customer experiences, and new growth opportunities.

Although challenges such as outdated systems and data privacy concerns exist, following best practices can help navigate these issues and fully leverage the potential of digital transformation.

By investing in the right technologies and maintaining a focus on customer needs, your insurance business can thrive in the digital age.

+1 315 210 4488

+1 315 210 4488 +91 99888 06489

+91 99888 06489